Banks have paid out £500,000 in redress to small businesses that were mis-sold interest rate swaps since the regulator ordered them to review 30,000 cases four months ago.

Just 10 offers of redress make up the £500,000, and the Financial Conduct Authority today said it expects that figure to “increase rapidly over the coming months”.

The banks are now processing more than 25,000 of the 30,000 cases under review, and have taken on 2800 extra staff to do so. Between them, they have already made provisions of £2.5 billion to cover compensation.

FCA chief executive Martin Wheatley said: “With 85% of cases now under review, banks have made progress. But like the thousands of affected small businesses, we want to see redress paid quickly to those who have suffered loss as the result of mis-selling.”

But John Allan, chairman of the Federation of Small Businesses, said: “We are quickly losing confidence in the banks and the regulator as this scheme remains unbelievably slow. The regulator initially indicated the redress scheme would take six months to complete — a timetable that has clearly been missed by a large margin.

“We warned that if the process isn’t quick and fair it would risk litigious claims, and further undermine confidence between small firms and the banks.”

The FCA said that around 1900 customers have or will shortly be offered redress by the banks.

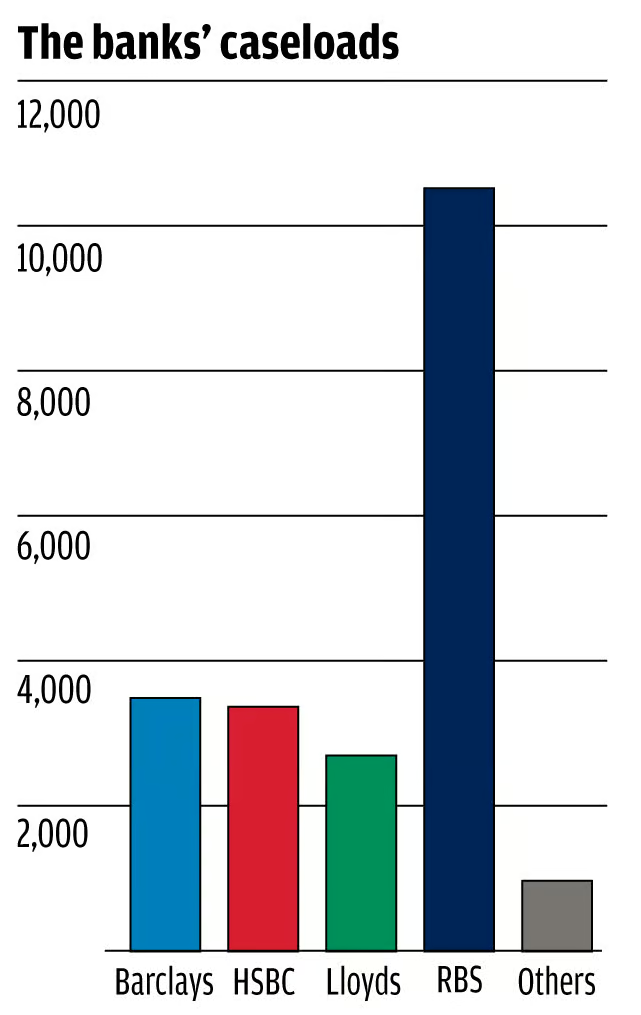

By far the largest group of mis-selling cases are at the taxpayer-controlled Royal Bank of Scotland.